👋 INTRO

Welcome back to my corner of the world. In future, I will try to stay away from similar posts, because I prefer to deliver actionable value. However, this post is necessary to understand why I’ve focused on stock investing - after all, you might see some parallels with your own life.

My 20s were dedicated to hustling. Also partying, but mostly hustling and figuring out how to make money. I never made it big. In fact, I failed more times than I can remember. One would argue that in my 20s I learned how to get comfortable failing.

Reaching my mid-30s, a burning desire to have a big company is out. Not that I’m giving up, but I’m redirecting my energy. Over the course of the last years, I realised I chased the wrong end of entrepreneurship. Let me explain.

Many entrepreneurs start because they hate being told what to do. Some start because they see the opportunity. A few are lured by the idea of immense wealth. But rarely do I hear an entrepreneur starting a business to have freedom. Warren Buffett and Charlie Munger best explain it in their 2021 CNBC interview titled “Wealth of Wisdom”.

… we made a lot of money. But what we really wanted was independence. And we have had the ability since pretty much a little after we met financially we could associate with people who we wanted to associate with. And if we had, if we associated with jerks, that was our problem. But we didn’t have to. We’ve had that luxury now for, you know, 60 years or close to it. And, and that beats 25-room houses and, you know, six cars or that stuff is, what really is great is if you can do what you want to do in life and associate with the people you want to associate with in life. And, now, it, it’s and, and we both had that, that spirit all the way through.

🏖️ DEFINING FREEDOM

I’m intrigued by billionaires. The status, the idea that someone amasses immense wealth, is still foreign to me. Of course, a lot of this comes from my upbringing and the beliefs that were instilled in me. But over the years, reading biographies, listening to the interviews, and drawing from my own experience, I’m realising the pinnacle of entrepreneurship is not power or wealth; it’s freedom.

Steve Jobs, a deceased Apple CEO, was once asked by Walter Isaacson (a biographer following Steve's last few months) why is he suddenly giving interviews so willingly. Steve replied: “I wanted my kids to know me. I wasn’t always there for them, and I wanted them to know why and to understand what I did.”

Warren Buffett, holder of the top ten wealthiest billionaire title, recently said: “When you get to my age, you’ll measure your success in life by how many people you want to have love you, actually do love you.”

Warren Buffett and Charlie Munger, longtime partners, image credit unknown/Google

It seems that family is the core of many billionaires. But what good is a family if you can’t spend time with them? Entrepreneurship, thus, in my definition, is having time and money to do what you want to do, when you want to do it. Which essentially is a description of freedom.

But how do you get to this stage? How can you constantly make money while having time to be with family and do the things you want? Now that’s a real question. Here is my thesis. It’s not verified yet, but there are a few people out there living it.

📈 STOCK INVESTING

Exploring various business models and mapping out my long-term future over the last few months, I’ve realised there is only one model that fits my desired lifestyle: stock investing. Here is why:

- Financial investments are by far the most passive method to make money

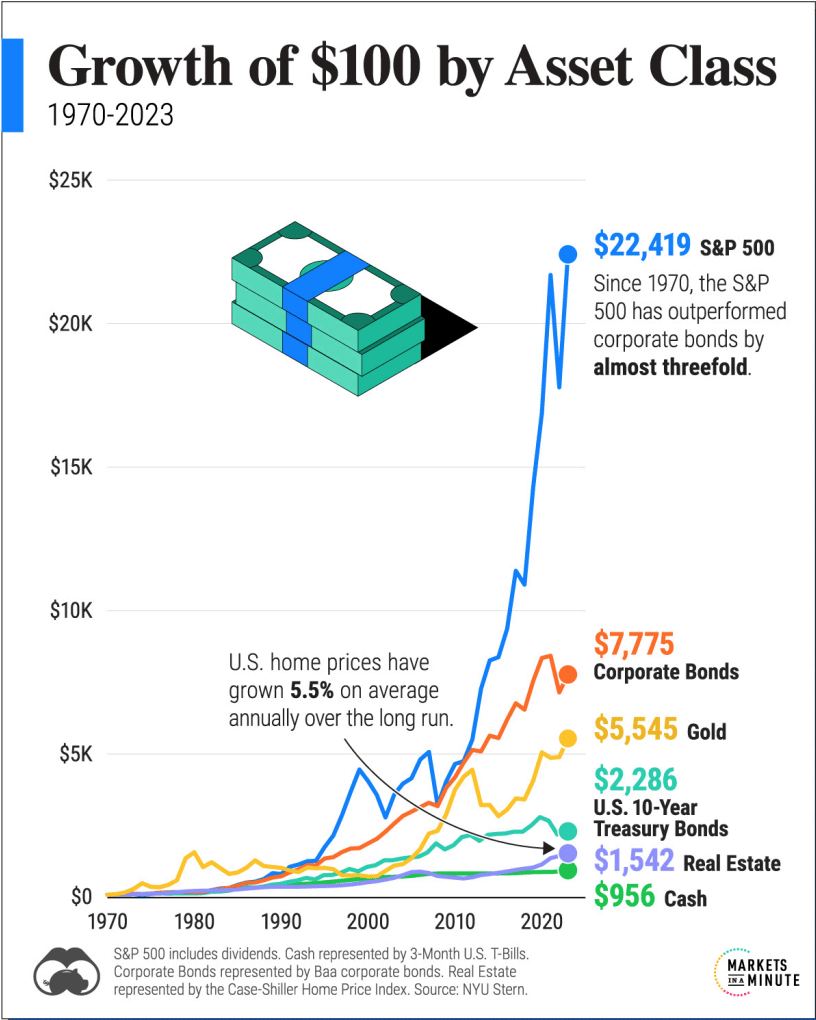

- Stocks historically outperform bonds, indexes or any other investment instruments

- Owning stocks means owning businesses, without being involved in management

- The majority of stocks are liquid, meaning they can be easily bought or sold

- Dividend stocks generate cash, non-dividend stocks generate capital gains.

- Stock transactions are instant and have little friction (you and the broker)

- Investing in stocks has the best tax brackets (depends on location as well)

- You are making money off businesses, without having employees, customers, contractors, properties or any other time and money-consuming dependencies

Image credit: Visual Capitalist

Putting it all together, it seems that stock investing is the ultimate vehicle to freedom and wealth. However, if stock investing was simple, everyone would do it. So what makes stock investing lucrative, yet unattainable by everyone?

In my opinion, there are two components of successful investing. A: capital. You need to have money to buy stocks. B: knowledge. You need to know what to buy and when to buy. Thus, stock investing is really a capital allocation at its finest form.

Realising my long-term future then requires two elements. Continuous, high-income, which will be converted into stocks and allocated time to learn and execute newly acquired strategies.

But there is another element that I want to introduce - patience. Not every day is a bull market; stocks also go down. I like to think of a path that I’m taking over the next years as a journey, rather than a destination. This eliminates the idea of sacrifice - work hard now, so you can play later. It doesn’t matter how much time it takes, but this is where I’m heading.

Image credit: First Trust Portfolios LP

Hopefully, by now I have made you excited and interested in stock investing. This is also the core idea of this newsletter: showing you what’s possible when investing in stocks and giving you actionable steps to do it on your own.

🙏 JOIN ME!

I’m truly excited for the future and I would like to invite you along on this journey. To make this more fun, I’m starting a small community for stock investors, called the Inner Circle. I don’t have specifics yet, but it will be a small circle of like-minded individuals (max 100 members), sharing learnings, experiences and memories. 👉 Apply here!

Here’s to a new journey, and thanks for reading!