Are stock markets around the world expensive? Let’s dive straight in.

💰 US STOCK MARKET

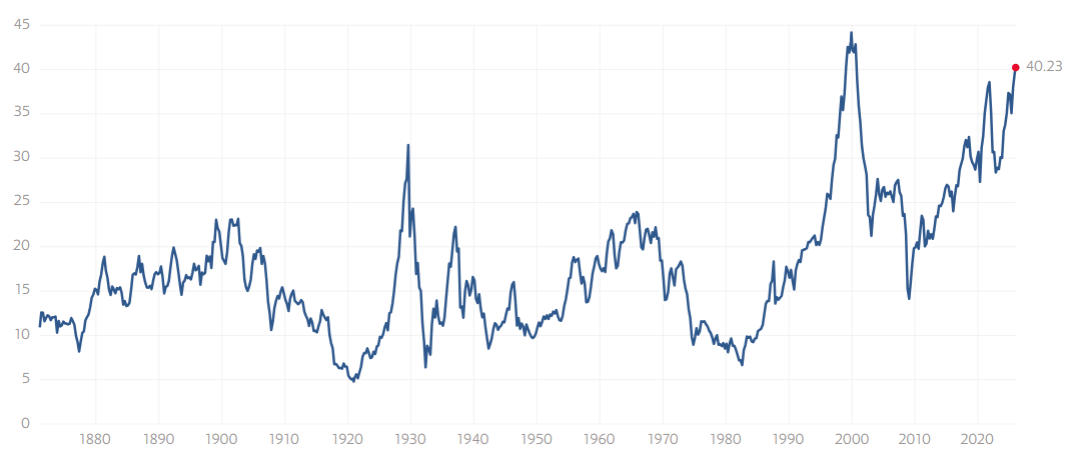

Shiller P/E ratio is 40.34 today (1.1.2026). Last time ratio was so high - 44.19 - is Dec 1999, just before the dot-com bubble burst. If you are new to the Shiller ratio, check out this webpage. Considering the historical median level is 17, US stock market seems to be overpriced by 135% today.

Image credit: Multpl

SP 500 PE ratio is 30.89 today (1.1.2026). Only three times was the ratio higher than today, in 2020, 2008 and 2000. If we follow the Rule of 20 and use a modest 2.7% inflation, we land at 33.59. Thus, the SP500 is currently trading at 68% premium.

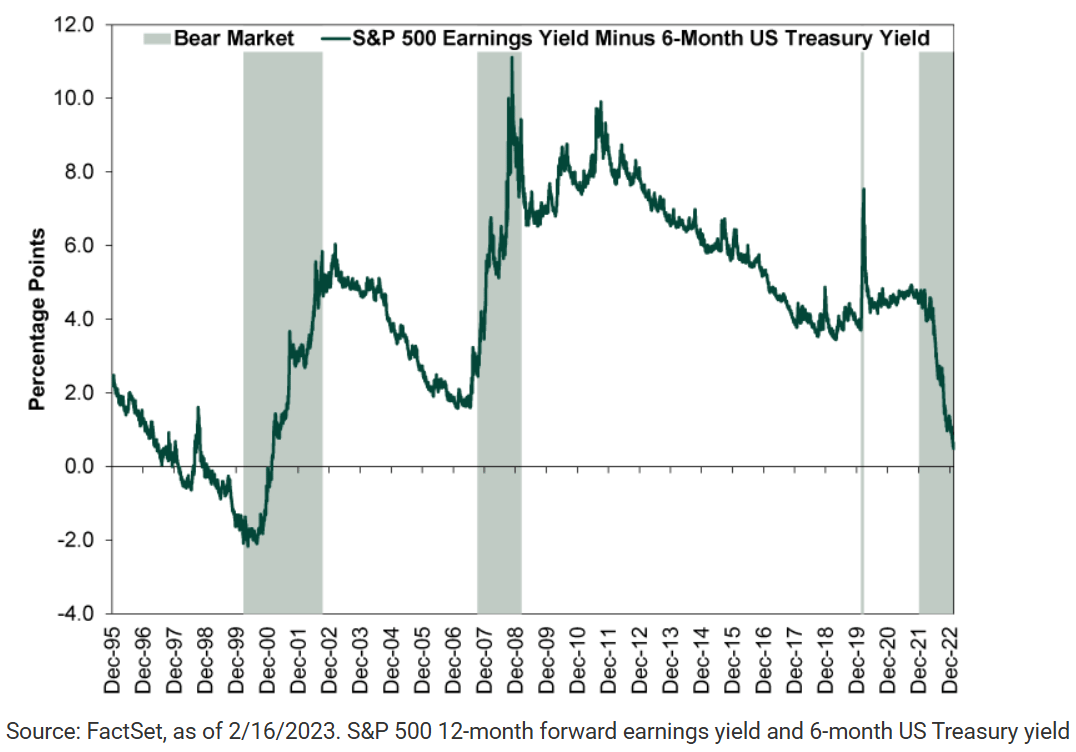

On the flip side, the SP500 earnings yield is 3.2%, meaning stock investors are accepting a lower return for higher risk. Meanwhile, 6-month U.S. Treasury Bills are paying 3.61% annual rate.

Image credit: Fisher Investments

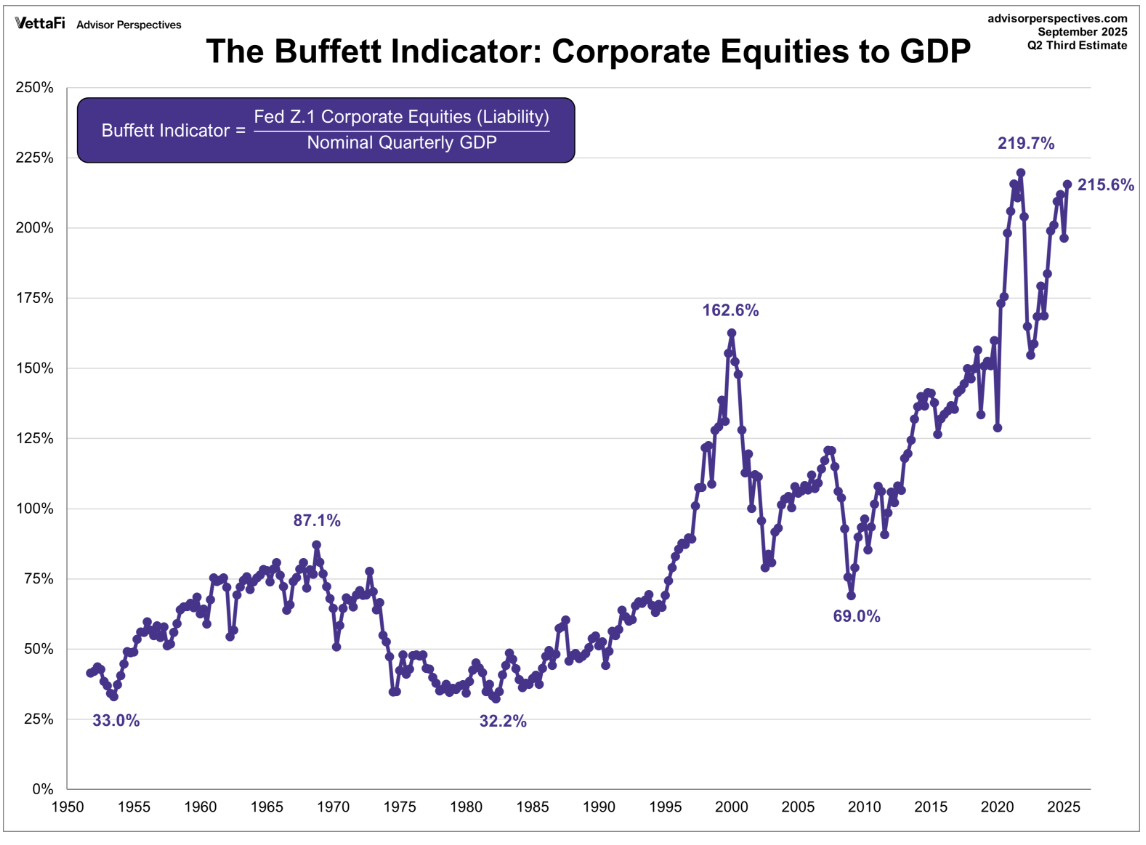

Buffett Indicator is at an all-time high, 225%. The price of the US stock market is more than double the actual economic output of the country. To restore the balance, either the economy must grow massively or the stock prices must fall. Remember though, markets can stay irrational much longer than an investor can stay solvent.

The last time the Buffett indicator was significantly overvalued was in 2020 and in the 2000s. Graph below.

Image credit: Advisor Perspectives

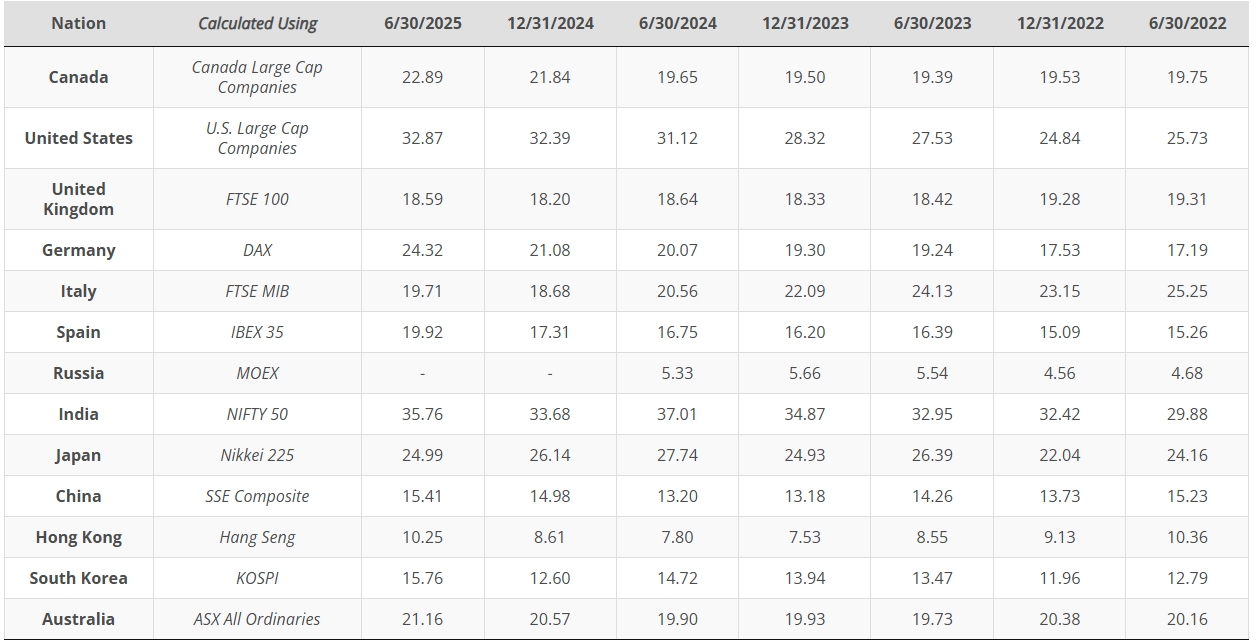

🌎 STOCK MARKETS WORLDWIDE

Whereas the US stock market seems to be through the roof, the rest of the world is modestly normal. Following the USA is India with a CAPE ratio of 36.4 and Japan with 25.8. While still lower than the USA, Japan’s CAPE is at a 30-year high.

At the bottom of the list, considered undervalued, are the United Kingdom with a CAPE ratio of 18, China with 15, Brazil with 11 and Hong Kong at 10. Interestingly, Brazil also offers one of the best earnings yields globally, currently at approximately 10.3%. CAPE ratios for international markets are estimates, not exact figures.

Image credit: Siblis Research

💣 MY TAKEAWAY

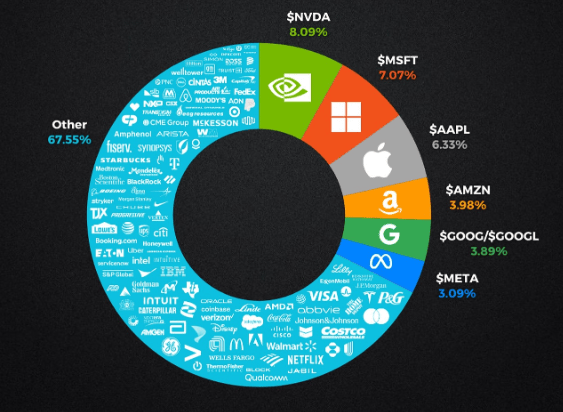

As it seems, the US stock market is considerably overvalued. But as with any valuation, we ought to be sceptical. The SP500 index, a leading US stock market indicator, consists of 500 individual stocks. The top 10 stocks account for nearly 35% of the index.

Image credit: Carbon Finance

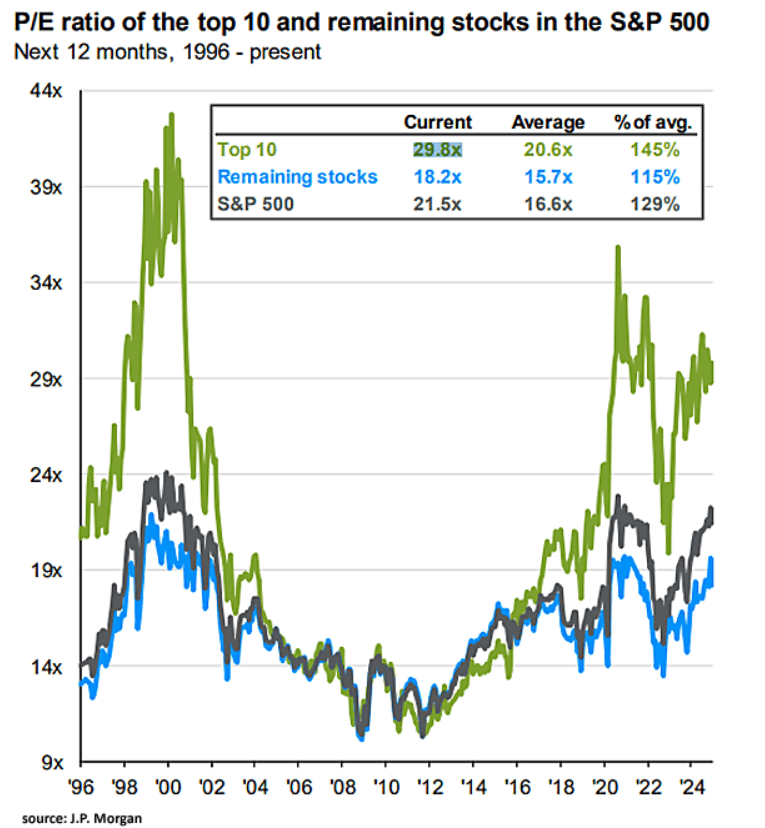

Earlier on, we established that the SP500 PE ratio is currently at 30.89, trading at a 68% premium (considering inflation). However, if we look at the top 10 stocks (and 35% weight they bear on the index), we get a different picture.

Image credit: J.P. Morgan / Isabelnet

It seems that the top 10 stocks are trading at considerably higher P/E ratios than the rest of the index. But let’s dive deeper. Let’s move away from SP500.

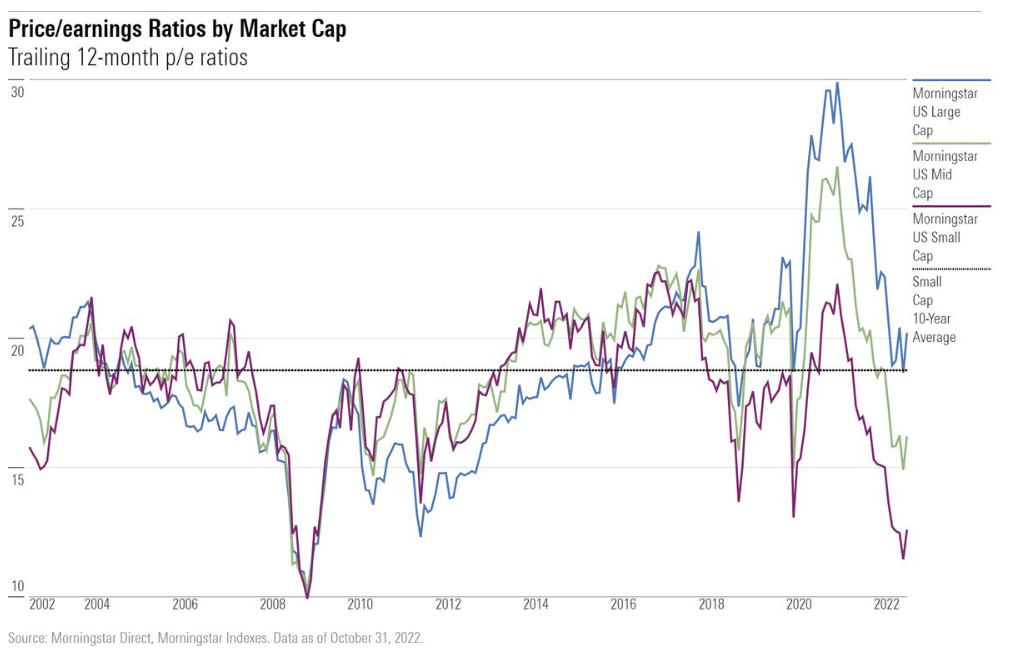

What are the P/E ratios in smaller markets? How expensive are small-caps or perhaps micro-caps currently in the USA?

SP600, a small-cap US index has a forward P/E ratio of 16.37. Russel Microcap index reports a 14.66 trailing P/E ratio, minus negative earnings.

Overall, small and micro-cap US markets look considerably more undervalued. What is even more encouraging is the graph below. The P/E ratio trend is reversing, favouring smaller market caps over the last few years.

Image credit: Morningstar

🙋♂️ FINAL THOUGHTS

On the outside, it seems that the US stock market went completely berserk, while the rest of the world is slowly following. But if you look under the hood, there are plenty of opportunities in smaller markets ready to be taken. Don’t let high P/E ratios of known stocks stop you from seizing opportunities. Remember, time in market beats timing the market.

Let me know in the comments what you think of the article. Also, I’m starting an inner circle for serious long-term stock investors, if that’s you 👉 click here